Adapting to the fast-paced and risky realities of today’s business world

In today’s volatile and fast-changing business landscape, no organization is immune to people risk. Economic uncertainty, evolving regulations, digital transformation, and shifting workforce dynamics have made companies more vulnerable than ever before. According to a PwC Pulse Survey, 75% of executives are struggling to keep up with the complexity and volume of regulatory changes.

Additionally, over 70% of organizations have experienced significant risk events or disruptions in the past five years, underscoring the critical need for robust risk management frameworks to ensure business continuity in an era of unprecedented uncertainty.

These challenges are often further amplified by internal inefficiencies:

- Risk exposure increases over time as your workforce and business operations evolve, making it harder to track risky individuals or decisions.

- Clunky back-office operations slow down critical screening processes, adding inefficiency and increasing the chances of overlooking significant threats.

- Decentralized management without standardized processes opens the door for inconsistencies, with no reliable way to manage risk uniformly across the organization.

- Struggling to establish selection criteria for key roles means screening reports can be inconsistently judged, allowing risks to slip through the cracks.

Without an effective and streamlined approach, risk exposure can snowball, leaving organizations vulnerable to everything from compliance violations to financial loss.

Horizon: A new way to monitor people risk factors

A Deloitte survey found that only 44% of executives feel that the risk-related metrics their organization captures give an adequate view of workforce risk exposure. This shows that even though companies recognize the human element in risk management, there is still a significant gap in their ability to monitor and mitigate these risks. Even more concerning, only 10% of executives are satisfied with how their organizations monitor people risk factors, highlighting the urgent need for change.

To help you overcome these obstacles, discover Horizon, our cutting-edge risk management platform designed to centralize and streamline your organization’s risk management processes, giving you total control over human-related risks.

With tailored verification structures, advanced algorithms predicting incident likelihood, and automated recurrent screenings, the platform provides a comprehensive, real-time view of potential risks across your workforce. These capabilities are delivered through several powerful features specifically designed to address the challenges of workforce risk management, such as:

- Automation of ongoing screenings to reduce manual tasks and ensure consistent verification processes.

- Risks ranking to help prioritize critical issues and prevent severe incidents.

- Holistic, real-time insights into the organizational risk landscape for better decision-making.

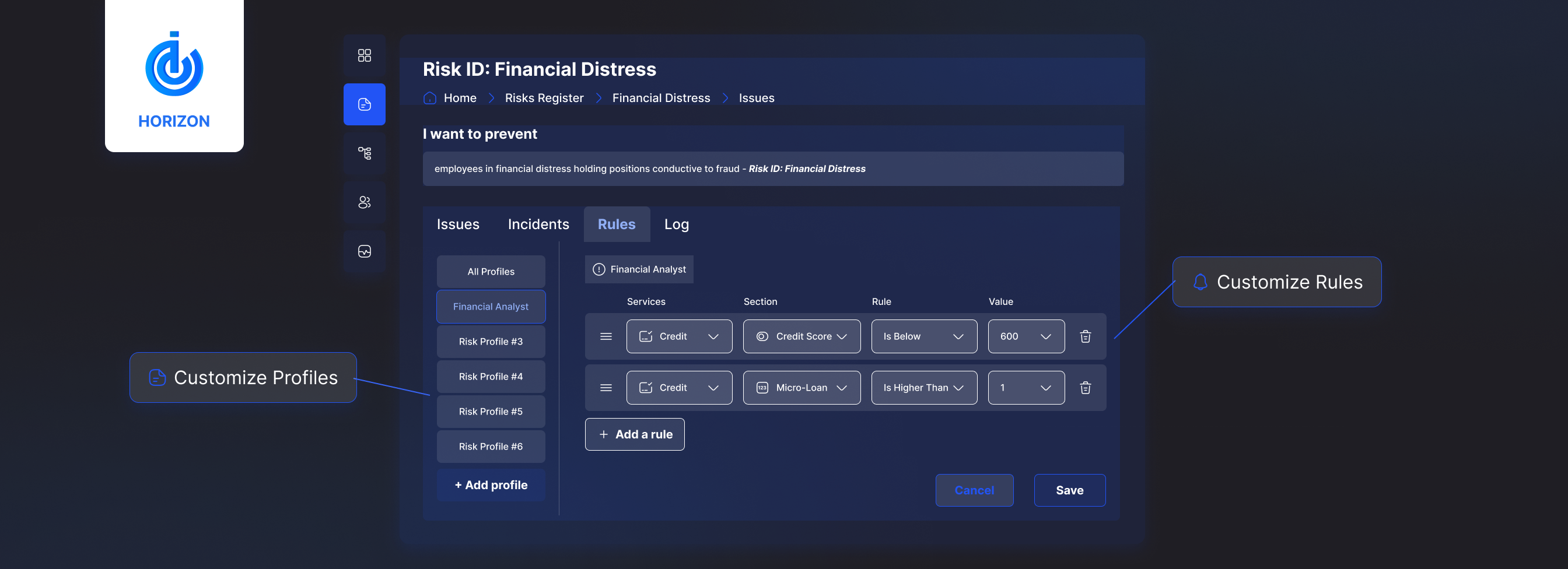

- Fully customizable rules and signals tailored to your organization policies for sustainable compliance.

Whether it’s identifying vulnerabilities in hiring processes or managing employee verification tasks, Horizon allows businesses to focus on what matters most—mitigating and preventing significant incidents before they occur.

How a midsize bank could use Horizon

To illustrate the power of Horizon, let’s consider MetroBank, a fictive financial institution with approximately 400 employees, providing services such as personal banking, mortgages, and business loans. As a regulated entity, MetroBank must ensure compliance with industry standards and labor laws while managing the hiring and ongoing verification of its workforce in key roles such as loan officers, accountants, etc.

The organization is struggling to manage its risk exposure, especially with regard to ensuring that employees in high-risk and high-profile positions are continuously vetted. Particularly as their roles within the organization and personal circumstances may evolve, continuous vetting becomes even more critical. The bank needs a way to automate compliance tasks, manage residual risks, and stay updated with changing labor regulations, but is facing numerous challenges:

- Limited Resources: Manually verifying employees and maintaining compliance with financial regulations is resource-intensive.

- Inconsistent screening: Different departments have varying standards for screening and verifying employees, which can result in potential compliance gaps.

- High-risk roles needing ongoing monitoring: Employees in roles like loan officers and financial advisors require continuous risk monitoring beyond just the initial hiring phase.

To address all these challenges, MetroBank could implement Horizon, allowing them to automate and streamline their compliance processes without the need for additional staff. Let’s explore how this implementation could unfold:

Screening levels by risk profile:

MetroBank created risk profiles for key roles, such as loan officers and accountants, setting custom rules to ensure compliance (e.g., verifying no bankruptcy history). The platform continuously monitored these profiles, alerting management to any non-compliance.

Recurrence of verifications:

The platform automated recurring background checks for high-risk roles, ensuring frequent verifications while reducing the administrative load on the compliance team.

Compliance with labor law regulations:

MetroBank used the platform to track and ensure compliance with varying labor laws across regions, automatically flagging any issues so the compliance team could act quickly.

Management of hiring and residual risks:

The platform’s algorithms flagged potential risks, such as financial misconduct, alerting HR and compliance for immediate action, ensuring a proactive approach to risk management.

Automatic analysis of verification reports:

Horizon automatically reviewed verification reports, quickly identifying risks or discrepancies, saving the compliance team time and ensuring prompt resolution of potential issues.

Traceability in the event of an incident:

In case of an audit or investigation, the platform provided complete traceability of all employee verifications, ensuring transparency and easy access to screening histories.

A new era in people risk management

Horizon doesn’t just follow industry standards—it adapts to your standards. Whether it’s ensuring compliance with financial regulations, legal requirements, or internal policies, the platform gives you complete control over risk management, providing the insights you need when you need them.

The platform’s ability to define automated, customized rules for evaluating employee risks ensures that everyone in your organization operates with the same risk management framework. This standardization enhances accountability, enabling you to maintain a proper risk tolerance level and stay proactive in mitigating risks.

Welcome to the future of people risk management